CombiCoin Weekly #10 & #11

We were a little busy so we skipped a weekly newsletter. CombiCoin hit a yearly low of $19.13 and we are glad to see it recovering steadily. We developed and released the buy back feature. And we executed the second “Revision and Rebalancing” of CombiCoin.

In this CombiCoin weekly the following things will be addressed:

- CombiCoin performance week 6 and 7

- Revision and Rebalancing of the “top 30” CombiCoin assets

- CombiCoin buy back feature launch & FAQ

- TRIA profit share & Snapshot

- AFM update

CombiCoin performance week 6

Weekly growth

Value on 05-02-2018 – 08:00 CET – $ 27.53

Value on 12-02-2018 – 08:00 CET – $ 29.57

+7.41% – (previous week -35.81%)

CombiCoin performance week 7

Value on 12-02-2018 – 08:00 CET – $ 29.57

Value on 19-02-2018 – 08:00 CET – $ 32.96

+11.46% – (previous week +7.41%)

All time growth: 281%

Monthly growth: -19%

Week high: $ 35.23

Week low: $ 29.09

Revision of the “top 30”

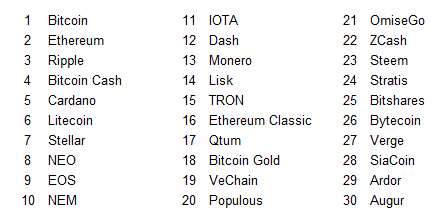

On Wednesday 14th of February 2018 the new “top 30” has been defined:

This means that we have said goodbye to the following cryptocurrencies.

- Waves

- HShare

- Komodo

- Ark

- Monacoin

- Nxt

We have decided not to include ICON and Nano because they are only listed on Binance. As we found out the hard way on the 8th of February to be able to trade CombiCoin we can not afford to depend on a single exchange.

We welcome the following cryptocurrencies to the top 30:

- TRON (TRX)

- Bitcoin Gold (BTG)

- VeChain (VEN)

- Bytecoin (BCN)

- Verge (XVG)

- SiaCoin (SC)

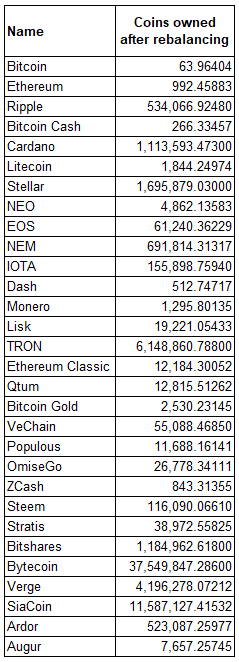

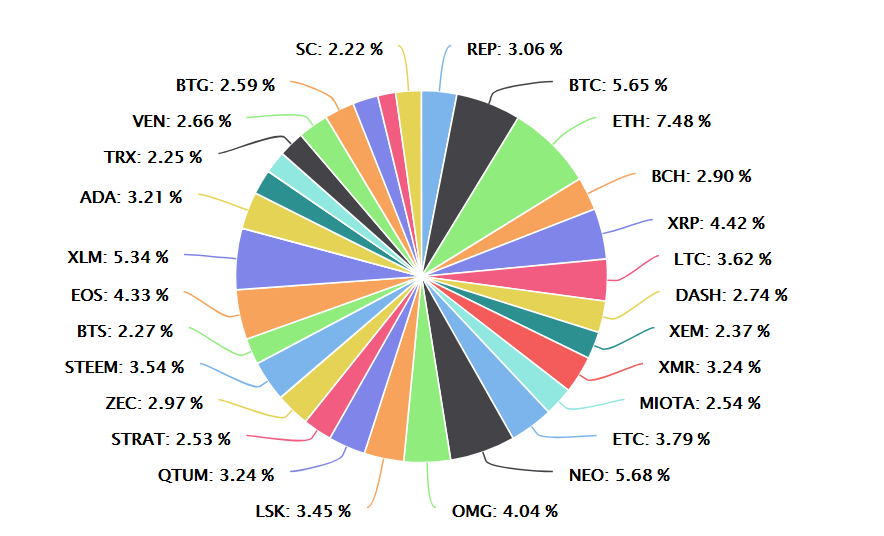

Rebalancing of the top 30

During the rebalancing of the assets backing CombiCoin the assets have been sold and bought. After rebalancing the distribution is as follows.

This resulted in the following change of the assets owned by the foundation.

Old asset pool

New asset pool

The next revision and rebalancing procedure is planned on 16-04-2018

Buy Back feature launch

In the first week of the launch we had problems getting the Buy Back feature fully online and we are very sorry we could not meet your expectations. Problems on Binance impacted our final test phase and also prevented us from going live on the 8th of February. Incidents like this however are not uncommon in the crypto- and software space and we depend on a lot of external factors beyond our control. We have learned valuable lessons and hope we kept you properly informed.

We are live now and although most CombiCoin clients choose to hold, some have sold successfully and received Ethereum in their wallets. There are still some final tweaks in the software happening right now. We implemented manual autorisations to be able to double check the amounts of cryptocurrency and the price. We want to make absolutely sure people receive the right amount of Ethereum for their CombiCoins. For a short period this does mean even best price orders are not processed immediately. We have a controlled flow of sales we start and stop and check manually during office hours. So far the software is doing great. We expect to see trading being fully automated soon and will inform you accordingly.

Buy Back feature FAQ

Will the price of CombiCoin go down if many people sell?

The answer is unequivocally no. The price of CombiCoin only changes if the price of the 30 cryptocurrencies in the portfolio change. CombiCoin holdings are a very tiny portion of the total market. Even if large amounts of CombiCoins are sold only small amounts compared to total daily trading volume of top 30 coins will be sold. Our actions will have no measurable effect on the price of the top 30 coins and therefore no effect on the price of CombiCoin.

Why do you charge 3.5% transaction costs?

The fees for buying and selling the CombiCoins are the only costs we charge our investors and therefore our only source of income. Unlike other investment funds we do not charge annual management fees, performance fees, or any other hidden costs in the price. This guarantees the maximum performance of the fund. For long-term holders of CombiCoin this generates the most profit. We understand 3.5% seems high for only processing the order but we pay all operational costs with these fees. These costs are put to the helpdesk, website, security, marketing, communication, salaries, administration and housing. And last but not least, 50% of the fees are paid as profit share to the TRIA token holders who made the start of the company possible.

Do I have to sell my CombiCoin?

The answer is no. If you want to sell you can do this from now on. But you don’t have to.

TRIA Profit share & Snapshot

In this profit share period from 16-01-2017 until 28-02-2018 the following amount of profit share per TRIA Token has been realised.

0.000057 ETH ( $ ~0.05)

On 28-02-2018 the TRIA Token snapshot will be taken. Please make sure that you do not have TRIA Tokens on a smart contract. Profit share send to a smart contract might not reach you and we will only send the profit share once!

Due to transaction cost and ethereum price, profit share can only be distributed when the profit share to be send exceeds the transaction costs.

AFM Update

Last week we had a meeting with the AFM regarding our current situation. Unfortunately things haven’t changed as of yet. The solutions that we provided during our meeting are currently under review. When things are more clear we will send you an update.